Tax Depreciation

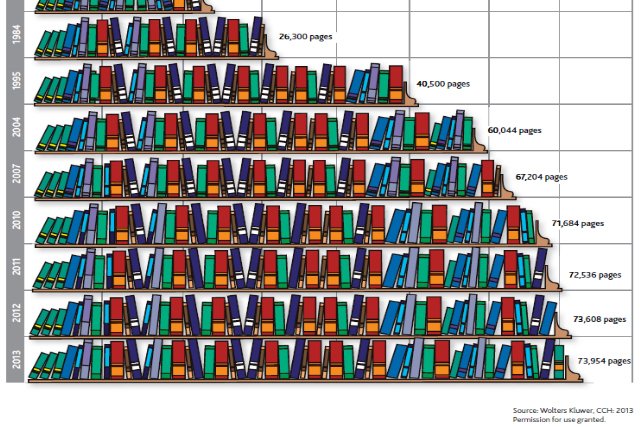

The printed IRS tax manual is literally more than 73,000 pages. IRS agents and their teams can’t even keep up with tax changes let alone the volumes of code. That’s why CPAs are more like general practitioners and need to rely on specialists to help maximize savings.

One such opportunity for maximizing savings is with depreciation for your buildings. When purchasing, refinancing or remodeling a building, your depreciation schedule is affected – or should be. Even though buildings have a typical 39 year depreciation basis, all the materials, wiring, insulation, fans lights and other components affixed to the structure need not have that looooong basis. As you can imagine, there are a lot of materials in a building that can (and should) have a much shorter depreciation period. Segregating or quantifying and adjusting those costs can result in substantial and immediate tax savings.

How much is this worth?

Say you remodeled or refinanced your half million dollar building 5 years ago, you might be eligible for a refund of $30k – $40k right now! Let’s say your building’s book value was $10M, you might expect to save $600k – $800k. Would that pay off debt? Fuel your next expansion? Buy a competitor? Kick start your retirment?

Is that it?

For many of our customers, we find 5x those amounts by combining other tax and utility savings! What if your profit margins went up 30% or 50% or doubled, sustainably? Would it change the valuation of your company? For most, that helps vault them to “top dog” status.

What if I delay?

Unfortunately, the ability to reclassify costs from past renovations will end with the 2018 tax year. While this method will not go way anytime soon, the ability to reach back in time will. So, if you remodeled or even had a small upgrade in the past, you must act now BEFORE filing your 2018 returns. Miss that window and you’ll throw away thousands in potential savings.

What if I do nothing?

If you get an email and don’t read it now or don’t reply right away, what are the chances you ever will? In the competitive business world, delaying and doing nothing are the same thing. Competitors are always looking for advantages to eliminate competition. This happens every day. One competitor quietly grows profits while others who don’t simply fade away into the sunset, never to be heard of again.

So don’t seal up the entrance to your “gold mine”. Let our engineering and construction experts find your hidden tax savings. For a free, no cost assessment that could change your business dramatically,

Click here to see if you qualify.

Leave a Reply

Want to join the discussion?Feel free to contribute!